HMRC had allowed a grace period for employers during the first year of their new PAYE scheme ‘Real Time Information’ or RTI as it became known, during this grace period errors in reporting details to HMRC or even late entries were overlooked as they ironed out the kinks in their new scheme.

Employers were given the benefit of the doubt and throughout late 2013 there have probably been thousands of potential causes which would normally have caused penalties to be issued, but they had not been.

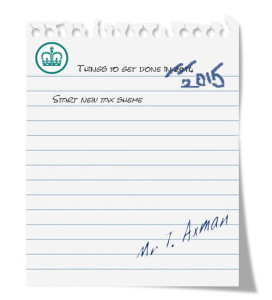

All of this was due to come to an abrupt close for the new tax year in 2014. As of 6th of April HMRC was to once again put on their stern tax-man face and were to re-start to impose penalties against the companies that failed to play by the rules, as the saying goes however – ‘the best laid schemes of mice and men often go awry’

All of this was due to come to an abrupt close for the new tax year in 2014. As of 6th of April HMRC was to once again put on their stern tax-man face and were to re-start to impose penalties against the companies that failed to play by the rules, as the saying goes however – ‘the best laid schemes of mice and men often go awry’

The Response

HMRC issued a statement explaining how they would instead now be staggering the timetable for their plans, beginning in April; interest will be payable for ‘in-year’ payments of PAYE and NIC (Pay As You Earn tax / National Insurance Contributions) later on (during October this year) automated penalties will be applied on those failing to file RTI (Real Time Information) reports and as of April next year PAYE and NICs will have their automated penalty systems brought into place.

So, there has been some reprieve, but certainly not a time to become too relaxed. Don’t be caught out by these changes in how business taxes are being handled.

find out more over at HMRCs own website: http://www.hmrc.gov.uk/payerti/getting-started/paye-basics/rti.htm