How You Can Close Your Company

Some directors assume that it’s as simple as sending off a signed form. In the most basic regard, that is the most simple action that is required. However, there are many legal stipulations and procedures that must be adhered to for a company closure to be in compliance with the Companies Act 2006 and ensure a legal and final closure of a company.

What are my options for company closure?Option 1 – Liquidation:

This is the more costly and more intrusive process, one which essentially removes the authority of a director. Control of the process and the business concerns are overseen by the appointed Insolvency Practitioner. A director that has previously liquidated a company can, in future engagements, be viewed as a higher investment risk, potentially affecting their ability to perform business in the future.

Option 2 – Strike off:

This can be performed by the director themselves, allowing them to retain control and also ensuring unnecessary costs are not incurred. The process does not demand that 3rd parties are given intrusive access into the business operations and the affairs of the directors personally. If correctly undertaken, a strike off has no lasting negative reflection on the directors.

Companies that are formed and registered within England and Wales have a record of their existence kept at Companies House. While this record is in place the company is considered operational and valid as such it is due to maintain records and to continue trading solvently.

- Striking off a company is the legal act for the removal of a company from the register.

- If a company is struck off from the register then it is noted as Dissolved. This process is referred to as Dissolution

- For a company to enters dissolution it must have reached a point where it’s debts have been repaid in full or negotiated to the satisfaction of the creditors.

- At the final point of dissolution any assets considered to still be owned by the company are absorbed by the crown.

- Without the procedure being followed correctly directors may become personally liable for the outstanding debts of the company.

- – Immediate steps can be taken to start closing your company.

- – No formal meeting of creditors.

- – It’s possible to write off thousands of pounds of bad business debt.

- – Not as intrusive as formal liquidation procedures.

- – You retain final control of the process.

- – It’s cheaper by far than liquidation.

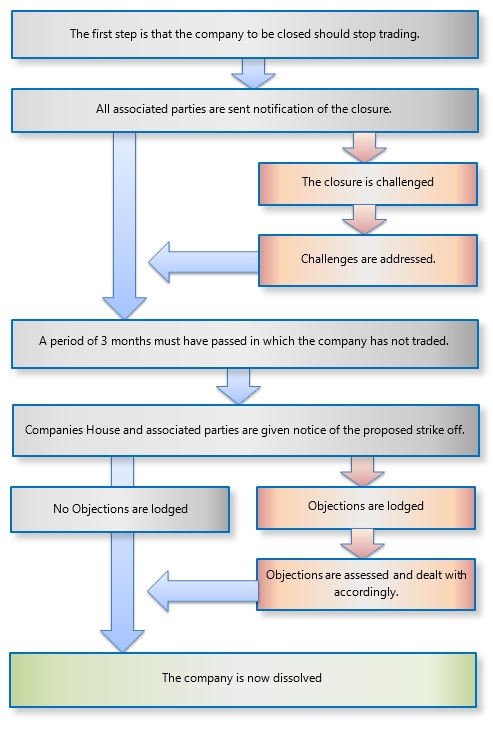

This simple flowchart shows the route and process of a dissolution

In our years of dealing with company closures we have come across many things that can disrupt or halt strike off proceedings, we’ve come to understand that each case brings its own problems, some examples we’ve dealt with include:

- Unhappy creditors/HMRC

- – Escalation of which can lead to such problems as:

- County Court Judgments.

- Bailiffs instruction.

- Wind up petitions.

- Objections lodged at Companies House will stop a dissolution.

- Accusation of wrongful trading can have implications for directors.

- Employment tribunals can arise should previous employees be unhappy at their dismissal.

- Not correctly filing returns can lead to objections from government bodies.

- Creditor forcing compulsory liquidation.

During your time in business, you may have learned how to keep business accounts, or proper stock control or other equally valuable traits. In all your time in business how much time have you given to learning the processes for closing the business?

Best practice is of course to focus on how to make a business prosper and flourish, but an equal amount of dedication should be paid to this final fanfare of operating a business. Don’t cause yourself more problems by not paying due diligence to your company’s requirements even in the course of closing it, do all you can to ensure the process is adhered to properly.

Need more advice?

If you have read through the basic advice above and still need some assistance we urge you to call and speak with one of our advisers, they will be able to talk more directly about your business and your circumstance and can give you some primary consultation on how you might be able to move forward.

Want to get things started?

Fill out this for to get our application download and an advisor will be in touch.